Governance

Board of Directors

The PMA Board of Directors shall have the authority, responsibility, and accountability to develop, establish, approve, and enforce policies and procedures necessary to implement the purposes and strategic plans of the Corporation.

Stella Hull-Lampkin

President

stellah@pilatesmethodalliance.org

Stella is currently the operations manager at BASI Pilates. She has more than 30 years of experience as a fitness professional and spent more than 18 years working in a managerial capacity for various companies, including Equinox. She loves to help people find their dreams and has mentored many to open their own studios and have successful careers in the Pilates industry. When she is not working as faculty for BASI, she can be found hiking on the trails in Orange County, working out in OrangeTheory Fitness, or gaming.

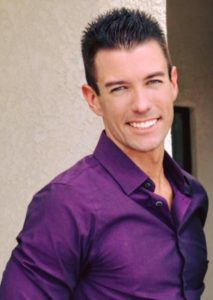

David McMahan

President Elect/ Secretary

davidm@pilatesmethodalliance.org

David, MFA, NCPT is a native of southern California and a graduate of the University of Arizona School of Dance and the University of California, Irvine. Through the influence of Pilates Elder Ron Fletcher and the mentorship of Kyria Sabin, he discovered his passion for empowering bodies through the Pilates method. Currently, a faculty member at Orange Coast College, David focuses on developing equitable educational practices for Pilates teacher training programming.

Eshael Johnson

Treasurer

eshaelj@pilatesmethodalliance.org

Eshael is a classically trained Pilates Instructor, GYROTONIC Apprentice, and owner of Ischyra Soma Fitness. Her love of all things athletic began while watching Super Bowl III with her father. After an accident that shattered her kneecap, her trainer recommended Pilates for subsequent knee problems, Eshael found that it allowed her to move with the grace she had before her injury. Eshael is convinced that Pilates can lead to “better living through strength and grace.” She is currently a communications and policy professional with the U.S. Government.

Moimusa Ahmadu

Director (voting)

moimusaa@pilatesmethodalliance.org

Moimusa is the sole proprietor of Guts Pilates and SportsMedicine. He is also the assistant athletic trainer in the sports medicine department at The Landon School for Boys. He started his career in Pilates in 1992 at the Pilates Center in Boulder, CO. Over the past 30 years, Moimusa has shared the virtues of the Pilates method globally as an instructor, teacher trainer, guest speaker, and presenter from Hong Kong to Brisbane and Durban to his native Freetown. He is sustained by the love of his two children and his large Sierra Leonean family.

Barbara Lauriat

Director (voting)

barbaral@pilatesmethodalliance.org

Dr. Lauriat is a member of the Bars of Massachusetts (2004) and New Hampshire (2005) and was called to the Bar of England and Wales in 2018. She teaches and researches intellectual property law in the law school at King’s College London, and is a Visiting Associate Professor at George Washington University. She did her mat work training with Body Control Pilates in London before completing comprehensive training through Balanced Body, and she is a Nationally Certified Pilates Teacher.

Karolina Schmid

Director (voting)

karolinas@pilatesmethodalliance.org

Karolina is from Zurich, Switzerland. She completed her undergraduate degree at the University of Toronto and a Master’s Equivalency in Health Policy at Humboldt University in Berlin. She began her Ph.D. at Humboldt and taught at the college level in Switzerland. Karolina is an author of numerous books and programs and runs the successful PILATESwiss Studios in Zurich. Karolina developed the Visceral approach to Pilates and yoga, which is supported by an independent medical advisory board.

Janet Gipson

Janet Gipson

Director (voting)

janetg@pilatesmethodalliance.org

Janet is Vice President of Talent Acquisition for Global Medical Response. She recognizes the parallels in sales, marketing, and talent acquisition, and pivoted to the recruitment space to help large, Fortune 500 companies put their best brand forward to attract talent. She was introduced to Pilates four years ago and is currently a student member of the Pilates Method Alliance while she works on her Mat certification. Janet is a compassionate professional always looking for ways to give back.

Bylaws

Bylaws are the rules that direct the board of directors in their work to oversee the corporation.

The Corporation

The PMA is a not-for-profit, 501(c)(3) organization incorporated in the State of Florida, USA.

What is a not-for-profit?

A not-for-profit organization is formed for the purpose of serving a public benefit, not for the pursuit of profits for owners or investors. Non-profits are not privately owned; they are governed by a board of directors who serve as unpaid volunteers. The board determines the organization’s mission, which is implemented by a salaried administrative staff. In the event the organization realizes a profit, that profit is reinvested back into the organization to support programs, develop the organization and promote its mission. Profits are not paid to an owner.

What is a 501(c)(3) organization?

A 501(c)(3) organization is a public service entity that qualifies for tax exemption under Internal Revenue Code Section 501(c)(3). Donors to a 501(c)(3) can claim tax deductions based on their contributions to the organization. (Members who derive an income from teaching Pilates may deduct membership and certification fees as business expenses.)

Board of Directors Meeting Minutes

The PMA’s Board of Directors meeting minutes can be found below.

Become a member today!